In the early hours of a Tuesday morning, the Francis Scott Key Bridge, an essential conduit for Baltimore and the U.S. East Coast's vibrant shipping activities, succumbed to disaster. A collision involving a container ship precipitated the collapse of a significant segment of the bridge into the Patapsco River, resulting in vehicles being submerged and triggering a vast search-and-rescue effort. This calamity has immediately disrupted operations at the Port of Baltimore, curtailing its connectivity to the Chesapeake Bay, and has broader implications for maritime and logistical networks due to the bridge's critical role in supporting commercial shipping access to the port.

In light of this incident, insights from Ryan Petersen, CEO and founder of Flexport, a forward-thinking freight forwarding and customs brokerage company, gain particular relevance. On Twitter, Petersen delved into the maritime law principle of "General Average," which redistributes the financial burden of such damages across all entities with cargo on the compromised vessel. This event severely challenges the Port of Baltimore, a pivotal node for substantial import and export volumes, amplifying existing logistical hurdles and potentially prompting a reassessment of shipping routes and insurance requirements for cargo companies.

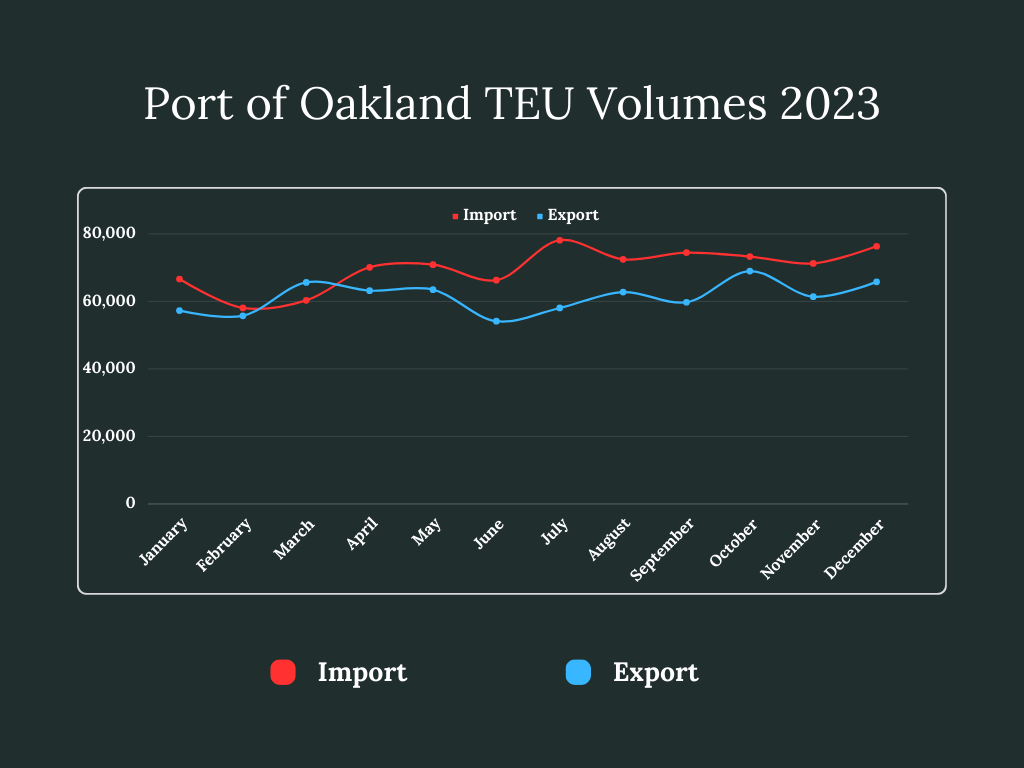

Furthering his analysis, Petersen elucidates the wider consequences of this bridge collapse on the shipping industry. Anticipated logistical bottlenecks and operational obstacles at one of the East Coast's key ports could inadvertently catalyze a shift in shipping volumes to West Coast ports. Driven by the urgent necessity to bypass the East Coast's logistical quagmires, this redirection might induce congestion and subsequent delays, evoking memories of the logistical difficulties experienced during the COVID pandemic. Such a shift underscores the delicate interdependencies within global shipping networks and illuminates the ripple effects of infrastructural setbacks on international commerce.